Can You Have Multiple PayPal Accounts? Your Complete Guide for 2026

Managing multiple PayPal accounts isn’t about shortcuts. It’s about staying in control as your payments, brands, and risk exposure grow.

In this article, we break down how multiple PayPal accounts actually work in 2026, what PayPal allows on paper, and what people do in practice to manage accounts safely without tripping automated reviews.

You’ll learn:

- How tools like Multilogin are used to isolate accounts properly

- When multiple accounts make sense and when they don’t

- What PayPal’s rules allow—and where they stop

- How account linking happens through devices, browsers, and IPs

- What real separation looks like when managing more than one account

Why Have Multiple PayPal Accounts?

One PayPal account works until it doesn’t. Once money starts moving in different directions, everything gets harder to track and risk increases.

Multiple PayPal accounts give you separation. How can you use it? Let’s cover the most common use cases:

- Different brands or projects

If you run more than one store or service, one account per brand makes revenue and refunds easier to follow. - Risk containment

PayPal reviews accounts automatically. If one account gets limited, others stay usable. That alone is a reason many businesses split accounts early. - Cleaner accounting

Separate transaction streams mean less cleanup at the end of the month and fewer surprises during tax season. - Different payment flows

Subscriptions, one-off payments, and marketplace payouts don’t always belong in the same account. Splitting them reduces friction.

This isn’t about convenience. It’s about control. Multiple accounts make PayPal easier to manage and less fragile as your operation grows.

Can I Have Two PayPal Accounts Legally?

Yes, PayPal permits one Personal account and one Business account per individual. This setup is completely legal and supported by PayPal’s terms of service. The idea is to separate personal transactions from business operations. However, for those running multiple online projects or brands, this limitation can feel restrictive.

PayPal strictly monitors account creation. Attempting to open two Personal or two Business accounts under the same name triggers red flags. Violations can lead to account suspension or even a permanent ban. To safely expand beyond this limit, you need a different approach—one that involves stealth techniques and strict separation of digital fingerprints.

PayPal’s account policies

PayPal enforces strict guidelines to prevent multi-account abuse. Here’s what you need to know:

- One personal and one business account: PayPal permits only one of each per user.

- Unique financial details required: You cannot link the same credit card, bank account, or email address across multiple accounts.

- IP and device tracking: PayPal monitors IP addresses and device fingerprints to detect linked accounts.

- Browser fingerprinting: Your browser’s unique signature can be traced across multiple logins, triggering red flags.

- Geolocation monitoring: Consistent logins from different locations without a VPN or proxy may lead to verification checks.

To safely manage more than two accounts, you need strict digital separation and privacy measures.

What Are the Different Types of PayPal Accounts

| Account Type | Purpose / Use Case | Key Features |

|---|---|---|

| Personal | Everyday use for individuals | Send/receive money, shop online, basic transactions |

| Business | Merchants or brands | Accept payments under a business name, invoicing, e-commerce integration, multi-user access |

Note: Premier accounts were previously available but are no longer offered. Their features have been merged into Personal and Business accounts.

How to create multiple PayPal accounts

Operating multiple PayPal accounts is possible if you use the right methods to stay under the radar. PayPal’s detection systems are designed to catch duplicate accounts, so each one needs to look completely unique. Here’s the step-by-step process to do it safely.

Step 1: Set up unique personal information

PayPal requires unique personal details for each account. This includes names, addresses, and phone numbers. Reusing any of this information across accounts can trigger immediate verification checks. Use virtual addresses, separate phone numbers, and unique email accounts to avoid detection.

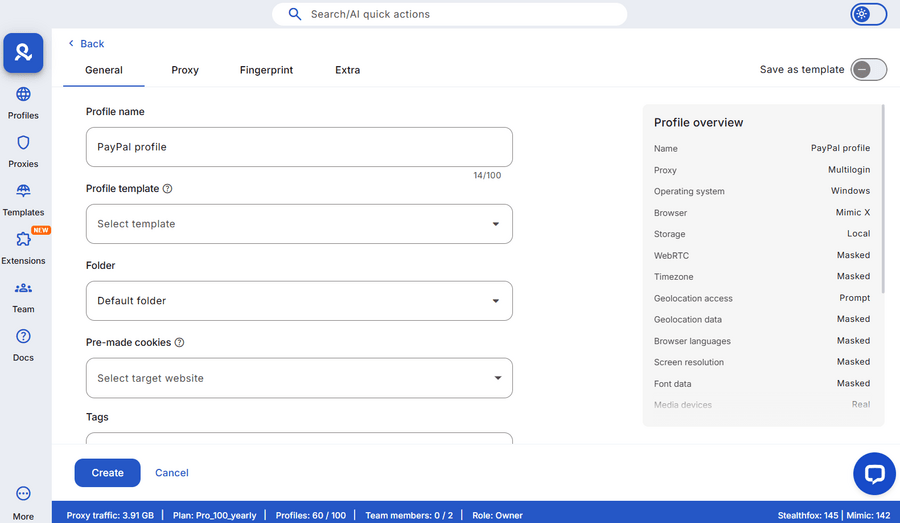

Step 2: Create isolated browser profiles with Multilogin

PayPal tracks browser fingerprints, which include everything from screen resolution to installed fonts. Using the same browser setup for different accounts exposes you instantly.

Multilogin lets you generate completely isolated browser profiles, each with its own fingerprint.

Pricing

Key Features

How to get started with PayPal accounts using Multilogin

- Choose a plan

- Download the Multilogin X app

- Create accounts and log in

- Open your workspace

- Click Create to set up a new browser profile

- Each profile has its own cookies, local storage, and browsing history.

- Switching between accounts is seamless—no overlap, no shared data.

- PayPal sees each login as a separate, legitimate user.

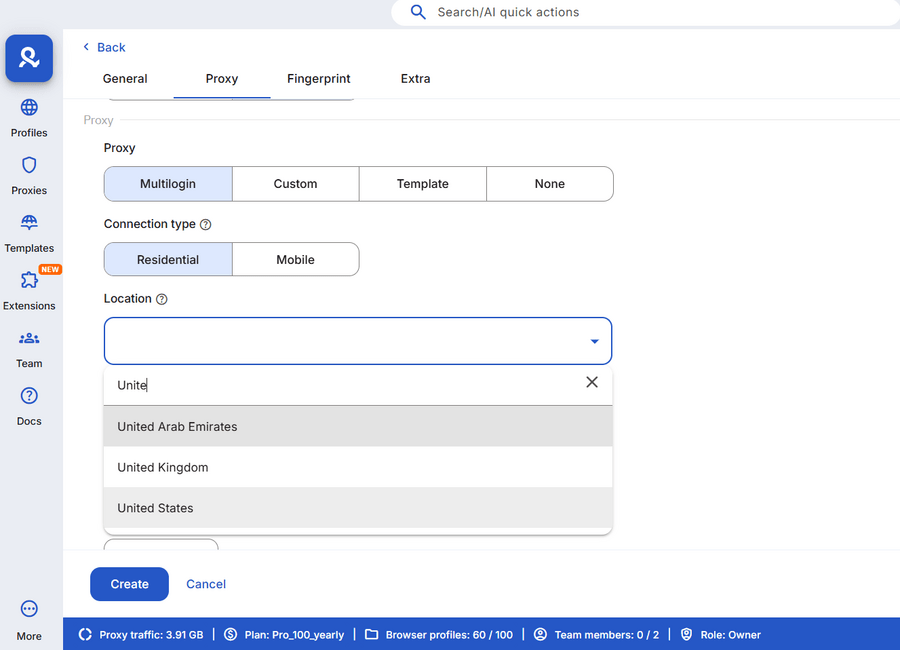

Step 3: Use Multilogin’s built-in residential proxies

When creating a browser profile for PayPal in Multilogin, simply select the location for your browser profile, down to the city and ISP level.

PayPal monitors IP addresses aggressively. If you access multiple accounts from the same IP, you’re flagged immediately. Multilogin handles this with built-in residential proxies—real IP addresses from genuine residential locations.

- No need for third-party proxies—everything is integrated.

- Each profile is assigned a different IP, mimicking separate locations.

- This segmentation prevents PayPal from linking your accounts.

Step 4: Avoid shared payment methods and emails

Each PayPal account must have its own payment methods—unique credit cards, bank accounts, and email addresses. Using the same card or bank information across profiles is a surefire way to get flagged. Virtual credit cards (VCCs) or separate bank accounts are ideal for this setup.

Step 5: Monitor your login patterns

Even with perfect separation, login habits matter. Accessing all accounts at the same time or from the same device risks detection. Stagger your logins and rotate devices if possible. Multilogin makes this easy by managing sessions independently.

Multiple Accounts Workflow Beyond PayPal

Managing multiple accounts isn’t just for PayPal. This approach can streamline your workflow, reduce risk, and help you handle different projects or brands more efficiently. You can also check our guides for other platforms:

- Learn how to switch Discord accounts on mobile.

- Managing Gmail accounts? Disover more in our article on unlimited Gmail accounts.

This way, the concept of isolated, multi-account management applies across tools and services, not just payments.

Stealth techniques for managing multiple PayPal accounts

Managing multiple PayPal accounts requires more than just different email addresses. PayPal’s detection systems track IP addresses, browser fingerprints, and device information to identify linked accounts. Here’s how to stay under the radar.

1. Understanding browser fingerprinting

Every time you log into PayPal, your browser transmits unique information about your device: screen resolution, timezone, installed plugins, and more. This fingerprint is nearly impossible to fake and allows PayPal to spot if multiple accounts are accessed from the same environment.

To avoid detection, you need a multi-profile browser. These tools, like Multilogin, create isolated browsing environments for each account. Each profile appears as if it’s coming from a different device, with its own unique fingerprint. This separation makes it impossible for PayPal to detect cross-account activity.

2. IP address segmentation

PayPal also monitors IP addresses to spot multiple logins. Accessing several accounts from the same IP triggers immediate suspicion. To solve this, use residential proxies or a dedicated VPN. A residential proxy assigns a different real-world IP to each session, making it look like each account is logged in from a different household or office.

3. Device isolation

Another layer of protection involves separating devices. Ideally, each PayPal account should have its own dedicated device or virtual machine. This eliminates overlapping data that could link accounts together.

Avoiding detection when managing multiple PayPal accounts

Creating multiple PayPal accounts is only half the battle—staying undetected is where the real challenge begins. PayPal’s anti-fraud systems actively monitor for suspicious behavior across accounts, and even minor slip-ups can trigger verification or permanent bans. Here’s how to avoid detection and keep your accounts running smoothly.

Maintain strict browser isolation

PayPal tracks not only your IP address but also your browser fingerprint. This includes device information, fonts, plugins, and even screen resolution. Accessing multiple accounts from the same browser—even in Incognito Mode—leaves traces that link your sessions.

- Multilogin provides isolated browser environments with unique fingerprints. Each session is completely sandboxed, preventing cross-contamination.

- Cookies, cache, and local storage are kept separate, ensuring PayPal cannot track your movements across accounts.

Use unique IP addresses consistently

Accessing different PayPal accounts from the same IP address is a red flag. PayPal’s systems are built to detect multiple logins from a single network. With Multilogin’s built-in residential proxies, each browser profile operates from its own IP address. These are genuine, residential IPs—not easily flagged by PayPal.

- Switching between profiles automatically changes the IP, keeping your activity hidden.

- No two accounts appear to come from the same location, even if managed from one device.

Avoid repetitive login patterns

Even with separate IPs and browsers, behavioral patterns matter. Logging into multiple accounts at the exact same time or in rapid succession creates a recognizable pattern. PayPal’s algorithms pick up on this, triggering security checks.

- Vary your login times and rotate through accounts strategically.

- Take short breaks between sessions to avoid predictable behaviors.

Avoid cross-account transactions

Transferring money directly between your PayPal accounts is one of the fastest ways to get flagged. PayPal’s system links accounts based on transaction history, especially if they involve the same IP or similar browser fingerprints.

- Always use an intermediary account if you need to move funds.

- Avoid frequent, identical transactions that could trigger scrutiny.

FAQ

Can I have multiple PayPal accounts in different countries?

PayPal’s policy only allows users to open accounts in the country where they reside and can provide valid proof of address. Attempting to create PayPal accounts in different countries without legitimate documentation is against their terms of service and can lead to permanent bans. If you operate internationally, consider setting up separate business entities with verified addresses for compliance.

Can I make another PayPal account with the same card?

No, PayPal does not allow the same credit card or bank account to be linked to multiple PayPal accounts. Sharing payment methods across accounts raises immediate red flags and triggers security checks. To manage multiple accounts safely, each one should have its own unique financial details. Virtual credit cards (VCCs) and separate bank accounts are practical solutions for this.

How many PayPal accounts are you allowed?

PayPal permits one Personal account and one Business account per individual. If you want to manage more than that, you need separate business entities or a stealth setup with unique details, IP addresses, and isolated browser environments. Tools like Multilogin make it possible to run multiple accounts safely without detection.

What is the difference between Personal and Business accounts?

A Personal account is designed for individual use—sending money to friends or family, making purchases, and receiving small payments. A Business account, on the other hand, is built for merchants and online sellers. It provides advanced features like invoicing, multi-user access, and integration with e-commerce platforms. PayPal allows one of each type per individual.

Is there an alternative to PayPal?

Yes, there are several alternatives to PayPal that support multiple accounts more flexibly. Stripe, Skrill, and Wise are popular options for international transactions and online business. However, if you want to stick with PayPal but need multiple accounts, tools like Multilogin allow you to operate stealth accounts without detection.

Can you have more than 1 PayPal account?

Officially, no. PayPal allows only one personal account per person and one business account per legal entity. Trying to create more than that can trigger restrictions or account reviews. That said, many people need multiple accounts for practical reasons. One personal, one business, and sometimes additional business accounts for separate brands or marketplaces. The trick is keeping them separate. Using unique emails, devices, and login environments reduces risk. Tools like Multilogin let you run multiple accounts in isolated browser profiles. Each account behaves as if it’s on a different device, making management easier and safer.

How many PayPal accounts can I have?

PayPal officially limits you to one personal and one business account. But in practice, the number you can operate depends on structure and purpose. Separate accounts for different brands or projects are common. The key is isolation. Each account should have its own email, login credentials, and environment. Using the same browser or device across accounts often leads to account linking and reviews. With Multilogin, you can create as many isolated profiles as you need, safely managing multiple accounts without overlapping session data.

Can you have more than one PayPal account?

Yes, but context matters. Multiple accounts are fine if they serve different purposes: personal, business, or separate entities. The risk arises when accounts share devices, IPs, or browsers. That’s when PayPal flags activity. Proper separation with unique emails and isolated environments reduces the chance of limitations. Tools like Multilogin make this straightforward by creating separate browser profiles, each acting like a distinct device.

Can you have 2 PayPal accounts?

Yes. Most people keep one personal and one business account. Some run multiple business accounts for different clients, brands, or marketplaces. Problems appear when both accounts are accessed in the same browser or device. Account activity, cookies, and IPs can link them. To avoid issues, each account should have a unique setup. Isolation tools or different devices make running two or more accounts safer and simpler.

Multiple accounts PayPal: is it risky?

It can be if done poorly. Logging into multiple accounts from the same device, browser, or network makes it easy for PayPal to link them. That can trigger reviews, temporary holds, or permanent limitations. Proper separation—different emails, devices, and isolated browser sessions—minimizes the risk. Using multiple accounts responsibly allows for distinct payment flows, separate brands, or different business units without triggering security checks.

PayPal: how many accounts can I have?

Officially, one personal and one business account. Practically, you can operate more with proper separation. Each account should have a unique purpose, email, and environment. Multilogin allows you to run as many accounts as needed by creating isolated browser profiles. Each profile mimics a separate device, letting you manage multiple PayPal accounts safely without triggering automated linking or reviews.

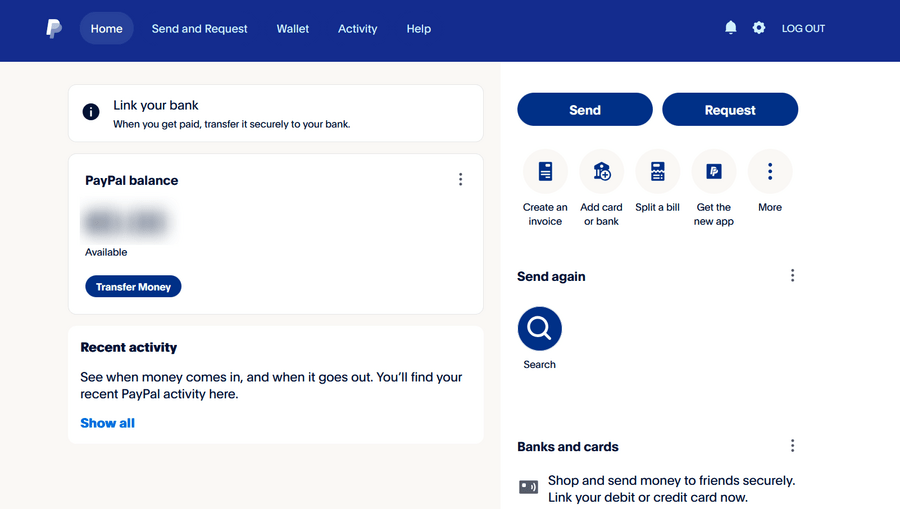

How do I make a new PayPal account?

Go to PayPal’s website and sign up for personal or business. You need a unique email and valid details. Business accounts require additional information, such as registration documents. Avoid using the same login environment across accounts. Using separate devices or isolated browser sessions prevents accounts from being linked and reduces the chance of restrictions.

PayPal sign online: what should I watch out for?

Logging in online is simple, but PayPal tracks devices, browsers, and IPs. Switching between multiple accounts on the same session often triggers security checks. To avoid interruptions, keep each account in a consistent environment. Use isolated browser profiles, dedicated sessions, or separate devices. This reduces verification prompts and keeps accounts operational.

Can you merge PayPal accounts?

No. PayPal does not allow merging accounts. If you have two accounts and want to consolidate funds, you must transfer money manually and close one. There’s no way to combine transaction histories, linked cards, or emails officially. Managing multiple accounts separately is the only viable method.

How do I set up 2 security PayPal accounts?

Treat each account as a separate system. Use different passwords, enable two-factor authentication for each, and avoid sharing recovery emails or phone numbers. For business accounts, set up admin permissions carefully. Isolating credentials prevents accidental account linking and adds security when managing multiple accounts.

Can you have two personal PayPal accounts?

According to PayPal’s terms, no. PayPal allows only one personal account per individual, and creating more than one personal account goes against their rules.

That said, in real-world operations, many users still run multiple PayPal accounts for different purposes. With tools like Multilogin, it’s technically possible to manage as many accounts as you need by keeping each one in a fully isolated browser environment. This separation helps prevent accounts from being automatically linked through shared devices or sessions.

The key point is understanding the difference between what PayPal officially allows and what is technically possible when accounts are properly separated.

Can I have 2 PayPal accounts with different emails?

Having different emails is required, but not enough. PayPal also tracks devices, cookies, and login behavior. Different emails help, but full separation is essential. Tools like Multilogin let each account run in an isolated browser profile, behaving like a separate device. This setup allows you to safely manage multiple accounts without them being automatically linked.

Conclusion

Operating multiple PayPal accounts legally and safely is entirely possible if you follow the right steps. PayPal’s detection systems are strong, but with proper isolation through Multilogin, built-in residential proxies, and unique browser environments, you can manage multiple profiles without triggering red flags. By segmenting personal information, using separate financial details, and avoiding repetitive login patterns, you minimize risk and maintain full control over your accounts.